Understanding the rational

Let's say you sell jewelry and your average ticket is R$1,000. To have a profitable business, you allow a maximum CPA of R$300. In other words, you agree to spend R$300 on online advertising to convert a customer who pays you an average of R$1,000. But is this really your customer's value? That's where the calculation of your customer's Real Value comes in.

If you suddenly discovered that your customer buys an average of three times in your store in a year, would you still be willing to spend only that R$300 to get it? Even if you knew he was going to spend R$3,000? Of course not! You'd certainly admit to spending at least R$900! This is simply why not considering your customer's Lifetime Value (LTV) can be a big mistake when calculating CPA.

Who should we use LTV for when calculating the CPA target?

If you are expanding your business, we strongly recommend using LTV as the basis for calculating CPA. This will increase the target CPA, enabling you to increase the volume of sales in your digital campaigns.

So increasing the CPA Meta can also increase the sales volume of the campaign?

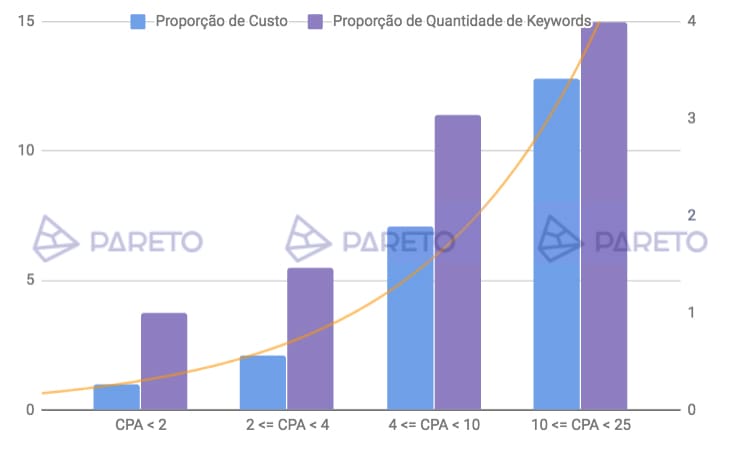

Exactly. The study below was carried out here at Pareto with 1 year's worth of data and over 20 million invested in Google AdWords. You can clearly see that there are many more words with high CPA and high spending potential than there are with low CPA.

In this way, the lower your CPA target, the more restricted we are in the number of words we have the potential to cost and, therefore, convert. This means that your account will have a limited volume. This is the importance of bringing LTV into the account. This way, you'll be able to put a higher value on a conversion, because you'll be looking at the customer's return over the long term and not just that one-off sale.

Case Study: Starbucks

Let's say six customers go into a Starbucks and spend, respectively:

s1= $3.5 / s2 = $8.5 / s3 = $5 / s4 = $6.5 / s5 = $6

Therefore, the Average Ticket (S) is worth $5.90.

These same customers end up returning to Starbucks several times a week. Let's take the total number of visits respectively: C1 = 4 / C2 = 3 / C3 = 5 / C4 = 6 / C5 = 3. Therefore, the average cycle of visits (C) is 4.2 times a week.

So the Average Customer Value (A) is simply C X S, right? No! The correct value comes from the average, calculated like this:

Average Customer Value = A = (c1 x s1 + c2 x s2 + c3 x s3 + c4 x s4 + c5 x s5)/5 = $24.30 per week

For the sake of curiosity, let's get into the NERD MODE: calculating Lifetime Value! To do this, let's declare some variables:

t = time that someone is actually your customer. In the case of Starbucks, an average of 20 years.

r = customer retention rate, i.e. the percentage of customers who, given a period of time, make a new purchase with you. In Starbucks' case, 75% retention.

P = profitability margin per customer. In Starbucks' case, 21.3% margin.

i = discount rate. This is a rate used in discounted cash flow to determine the present value of a future cash flow. It usually ranges from 8 to 15%. In the case of Starbucks, 10%.S = average ticket

C = average cycle of visits per week

A = customer value per week

METHOD 1: LIFETIME VALUE EQUATION (a)

In the case of Starbucks, let's use time in weeks. As we have 52 weeks in the year, the equation looks like this:

CLV(1) = 52 x A x t = $25,272.00

METHOD 2: LIFETIME VALUE EQUATION (b)

CLV(2) = 52 x t x S x C x P = $5,489.00

Note that in this case we are already considering the company's margin, giving an expected return on profit.

METHOD 3: LIFETIME VALUE EQUATION (c)

m = Gross margin = 52 x A x t x P = $5,382.94

CLV(3) = m x ( r / (1 + i - r ) ) i.e. CLV = $11,535

Finally, which method to choose? If I were you, I'd go for the third method. For me, it's by far the best. But if it gets complicated, start with the first. That's how it is. Remember how I talked about analyzing limits? The lower limit, or the simplest account, is the first step you need to take to begin to understand your consumer's behavior. To finish, just as an example, the average of the three calculations came to $14,099. This is a good reference value.

Now, can you imagine if all Starbucks took into account when marketing was the $5.90 average ticket? That's what you're probably doing today. Take a moment and calculate your CLV. All of the top ten clients (in terms of results) that we have at Pareto Group today use CLV as the basis for calculating their CPA.

Article summary in 30 seconds

The impact of your Sponsored Link campaigns is much greater than you think. Every time we convert a NEW CUSTOMER, you're not just acquiring that purchase price, but the entire CLV I've talked about in this article. And there's more. Your CPA should be a simple function of CLV, not your Average Ticket. But what if you still can't calculate the CLV? Relax. It happens in the best families. The important thing to note is that the famous ROI, or ROAS, as we prefer, is always calculated on turnover. And this turnover doesn't take into account the return your customer will give you in the months and years to come. So think TWICE before you set that MINIMUM ROAS for your campaign so high, because it will certainly DECREASE your SALES VOLUME, meaning that at the end of the day you will stop making a profit.