Intel's recent devaluation serves as a stark warning to the corporate world: in the Artificial Intelligence (AI) landscape, even the giants can stumble. This article explores how AI is redefining the technology market, turning risks into reality for companies that don't adapt quickly.

The AI Butterfly Effect: How Small Changes Make Big Impacts

Chaos theory teaches us that small changes can have huge consequences. In the world of technology, AI is that "butterfly flapping". What started out as a promising technology quickly became a game changer.

Intel, the undisputed leader in the chip market for decades, has seen its market value plummet by 26% in a single day. This is not an isolated event, but the result of a series of small decisions and delays that, over time, have culminated in a significant loss of relevance in the AI market.

Important facts:

- Nvidia, Intel's main competitor in the AI chip market, now has a market value 30 times greater.

- In 2000, Intel was worth $500 billion (equivalent to $900 billion today). Today, its value is a fraction of that.

The Success Trap: Why Established Companies Are More Vulnerable

The paradox of innovation lies in the fact that past success can be the biggest obstacle to future adaptation. Intel, like many established companies, fell into the trap of its own success.

Market-leading companies often:

- They focus too much on protecting existing products

- Underestimate new technologies that don't fit into their current business models

- They resist drastic changes for fear of cannibalizing their own offerings

Intel dominated the CPU market for years, but failed to adequately position itself in the GPU market, which is essential for AI processing. This lack of diversification and innovation has paved the way for competitors such as Nvidia.

The Cost of Inaction: Quantifying the Losses of AI Resistance

Resisting or adopting AI slowly is not just a question of missing opportunities, but of incurring real and measurable losses:

- Net Loss and Revenue: Intel reported a net loss of $1.6 billion for the second quarter of 2024, consistent with its results for the same quarter in 2023. Its revenue for this quarter was $12.8 billion, down 1% year-on-year.

- Earnings Per Share: The company posted an earnings per share (EPS) loss of $0.38 (GAAP) and $0.02 (non-GAAP), failing to meet expectations of a $0.10 profit.

- Workforce and Expense Reductions: Intel announced plans to cut 15% of its workforce and aims to reduce its operating expenses by $20 billion in 2024 and $17.5 billion in 2025.

- Stock Performance: Intel shares experienced a significant drop, falling more than 20% after the release of the financial report and more than 30% over the past year.

- Future Guidance: Intel expects revenues between $12.5 billion and $13.5 billion for the third quarter of 2024, with a projected GAAP gross margin of 34.5% and an EPS loss of $0.24 (GAAP).

The company announced cuts of 15% in its workforce and a reduction of $10 billion in expenses by 2025.

Intel shares are at their lowest level since 2013, representing a decade of stagnation for investors.

These figures clearly illustrate the real cost of not adapting quickly to the changes brought about by AI.

Corporate Reinvention: Strategies for Navigating the Age of AI

Although the scenario seems challenging, there are strategies that companies can adopt to successfully navigate the AI era:

- Investment in R&D: Allocate significant resources to research and development in AI.

- Strategic Partnerships: Collaborating with startups and academic institutions to accelerate innovation.

- Culture of Innovation: Fostering a mindset of experimentation and continuous learning throughout the organization.

- Diversification: Not relying on a single product or market, but exploring various applications of AI.

- Organizational agility: Creating more flexible structures that allow rapid adaptation to market changes.

Intel, for example, is trying to reinvent itself with massive investments in new chip factories in the US, supported by the US government through the Chips Act. However, the success of this strategy remains to be seen.

The Intel Dilemma: A Warning for SMEs

If global leaders like Intel are struggling to adapt to the AI revolution, the implications for small and medium-sized enterprises (SMEs) are even more profound. Intel's significant challenges, including a 20% drop in share value following disappointing financial results and a billion-dollar cost-cutting plan, highlight the critical importance of adapting quickly. These difficulties underscore that even industry giants are not immune to the rapid advances and demands of AI.

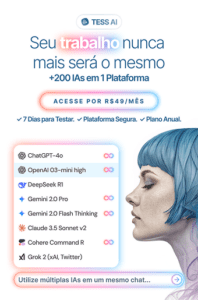

For SMEs, the most effective way to enter this revolution is through AI platforms like Tess AI. These no-code solutions offer companies complete and agile adaptation to the era of generative AI, providing essential tools to compete and thrive in today's market. Adopting generative AI technologies is not just an option, but a strategic necessity to ensure continued growth and survival. Leveraging platforms like Tess AI can help SMEs stay ahead in a competitive landscape, allowing them to harness the full potential of AI without the need for extensive technical expertise.

Conclusion

The AI revolution is not a distant threat, but a present reality that is reshaping the corporate landscape right now. The Intel case serves as a valuable study of the risks of underestimating the impact of AI.

Companies that manage to embrace change, invest in innovation and adapt quickly will have a better chance of surviving and thriving. Those that resist or are slow to act may find themselves in the same position as Intel: struggling to make up lost ground in a market that waits for no one.

The message is clear: in the age of AI, complacency is the biggest risk. The ability to continually reinvent oneself is no longer a differentiator, but a necessity for corporate survival.