Hootsuite + We are social = OMG!

"Hootsuite" and "We are social " are two digital marketing agencies specializing in social media and operating worldwide. Together, they produce one of the most respected reports in digital marketing!

There are more than 200 pages with essential information for the marketing manager. And from them, you can discover a range of information and insights, such as the growth of each social network, distribution by demographic characteristics and the main trends in e-commerce!

The survey results are consolidated for the whole world or separated out for each country, including Brazil.

Some interesting facts are also shown, such as the most visited websites, the most popular searches, the most accessed social networks, the most influential profiles and the most downloaded apps.

In the following article, you'll find the report's main results and insights for 2019. Take a look!

What do we see on the internet these days?

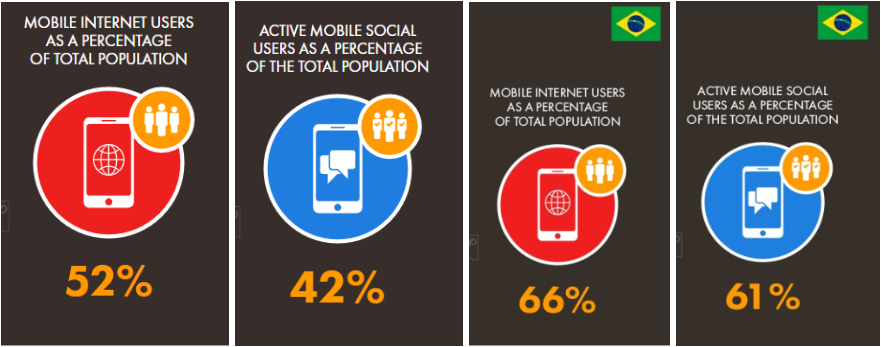

We began this article by talking about the penetration of internet users and social networks in Brazil and around the world.

In this case, the term "Penetration" represents the "Percentage of Users" over the "Total Population" of each territory.

First of all, it's important to note that today 70% of the Brazilian population already uses the internet. This figure is above the world average, but still low compared to more developed countries around the globe.

This indicates a gap that could be filled in the future, characterizing it as a potential for growth in the markets studied below (social networks and e-commerce).

Compared to other countries, Brazil also has good penetration of social networks. 66% of Tupiniquins use them, which shows the strength of this market here.

Growth in internet users

Since 2014, the number of internet users has been growing at an annual rate of 12% per year. This figure is even higher for social media users, with an increase of 13% per year, as we can see below:

Time connected to the internet

Studying the habits of each nationality, it can be seen that Brazilians spend a good part of their day connected to the internet, especially on social networks.

We are second only to the Philippines in the amount of time spent per day on these activities.

In Brazil, 9 hours and 29 minutes are spent on the internet per day. Around 40% of this time is spent on social networks (3h34min). And almost the same amount is spent on videos (3h26min).

It's worth noting that 85% of Brazilians access social networks at least once a day. And another 9% at least once a week.

This shows how connected we are to these platforms and how we can be impacted by marketing through them.

Access Channels: expansion of Mobile Devices

In addition to usage, internet access channels also provide us with interesting insights .

Mobile devices, for example, are increasingly present, with a major evolution in the last five years. To give you an idea, the time spent on the web via smartphones has jumped from 26% to 48%.

More than half the world's population already uses this type of device to access the internet. In Brazil, more than 60% of the population accesses the internet and social networks via cell phones and tablets. That's an increase of 13% a year!

However, while the increase in internet and social media users has been below 15% per year over the last five years, the growth in mobile social media users has been an impressive 30% per year.

Based on the Facebook audience impacted by ads, 96% access the platform via smartphones and tablets. While only 25% do so via desktops.

This proves the worldwide trend towards greater use of mobile access channels, regardless of the purpose (leisure, shopping, etc.).

Social Networks - The most accessed and the most searched

Comparing social networks by the number of accounts, Facebook, Youtube and Whatsapp have the most access in Brazil and worldwide. Instagram always appears as the fourth most used social network.

This result is also reflected in the most accessed sites and the highest volume searches on Google.

Considering direct accesses, Google, Youtube and Facebook are the three most accessed sites in Brazil and worldwide.

As for search engines, the same sites are the most popular with users. But in this case, the order changes slightly, with Facebook in first place, followed by Youtube and Google.

Twitter and Instagram are the 7th and 10th most accessed websites in the world. In addition, Instagram is the 13th most popular search.

In Brazil, Instagram is the 13th most accessed website.

We've given you an overview of the consolidated data here, but the audience of each social network will be explored in more detail later. Be sure to check it out!

Demographic data

In Brazil, in terms of Internet access, the demographic characteristics that stand out are: people between the ages of 18 and 44, especially women.

Worldwide, we have very different characteristics: the majority of the internet audience is younger and male.

However, these gender figures are strongly influenced by culture in some regions. In African and Asian culture, for example, the male audience has a greater than 75% share of the online universe.

If we look at the same data for other countries, we see a much better balance. There are few cases of a male majority, for example Germany, Switzerland and Sweden; just as there are few countries where the majority is female, such as Portugal, Spain and Argentina.

The evolution of web users already shown, the number of monthly clicks on Facebook and the use of Adblockers indicate that Brazil is a very interesting environment for digital marketing.

Compared to the rest of the world, we have the fifth highest number of clicks on Facebook and are below average in the use of Adblockers, as you can see in the graphs below:

The audience of each social network

Analyzing the global audience impacted by ads on each social network, we note that the highest volumes are on Facebook, Instagram and Linkedin.

In Brazil, women are in the majority on all social networks except Linkedin and Twitter. This is different from the rest of the world, where the female majority is only found on Snapchat.

As mentioned in Demographic Data, we consider this global gender data to be highly influenced by the characteristics of certain countries.

According to the profile of each social network in the world, it can be concluded that:

- Looking only at the age group, the older public is most impacted by Linkedin. This is followed by Facebook, Instagram, Twitter and, finally, Snapchat;

- The male audience, as mentioned above, is most impacted by Twitter, followed by Facebook, Linkedin, Instagram and, lastly, Snapchat;

- In the case of Brazil, women are most impacted by Snapchat, followed by Instagram, Facebook, Linkedin and, finally, Twitter.

It is worth mentioning that we have analyzed gender data in countries with a similar culture to ours, such as North and South America and Western Europe, and this same pattern is repeated.

Eligible penetration

With regard to the eligible penetration of each social network in Brazil (percentage of users in the population over 13), the study shows that:

- 75% of the Brazilian population is on Facebook and 40% on Instagram. Figures well above the global average of 35% and 15% respectively;

- The figures are lower than the penetration of Snapchat (6%) and Twitter (5%);

- In the case of Linkedin, the study was carried out with people over the age of 18, giving a result of 23%. This is well above the global average of 11%.

Depending on the online advertiser's product or service, it's important to have these insights in order to bid higher to an audience with a greater chance of conversion.

Google and Facebook are the biggest platforms for digital marketing. However, other options, such as Linkedin for an older and/or corporate audience or Instagram for women, can complement the campaign strategy.

You've talked about the Internet, you've talked about ads, you've talked about E-commerce!

E-commerce in the world

Studying global data from the E-commerce sector, we note that 84% of Internet users have searched for a product or service and that 91% of them have visited an online store.

Three quarters of these users bought something online regardless of the device. Most purchases were made via mobile devices (55%), in line with the trend towards smartphone use mentioned above.

E-commerce in Brazil

In Brazil, the percentage of searches is higher (89%). However, there are fewer cases of purchases (68%), indicating a conversion rate of 76%.

In addition, purchases via notebooks and desktops are still the majority here, a scenario that is changing over the years.

It's worth noting that care should be taken when using these conversion rates as a benchmark. Depending on the product/service offered and the sector it is in, they can vary greatly.

Below, we'll show you data from each sector. Keep up to date!

E-commerce and M-commerce

Compared to the rest of the world, Brazil still has a low percentage of E-commerce and M-commerce purchases, both below the global average.

The reasons for this could be low internet penetration, slow connection speeds (below world averages for all types of devices) and high distrust of data security (third highest in the world).

However, as already mentioned, these could be indicative of potential growth in this market in future years. It will depend on the future prospects for our country.

Largest Sectors in Brazil and the World

When analyzed by sector, both in Brazil and worldwide, the largest markets are Travel and Hospitality, Fashion and Beauty, Electronics, Leisure and Food, in that order.

It's important to note that all categories showed annual growth of close to 10% on Brazilian soil.

Worldwide, the figures were in the same order of magnitude for all cases, except for music and video games, which grew less, by around 5%.

Conclusion

We then conclude that there is a great opportunity to invest in digital media in the country, given that Brazilians spend a large part of their day connected, with a high number of clicks on ads and low use of Ad Blockers.

And, as you might expect, Facebook is the network with the most users. So the chances of reaching more people through it are greater.

However, a well put together strategy can add a lot by bringing in new audiences on other networks, such as a younger female audience on Instagram or a more adult male audience on LinkedIn.

Finally, it's worth noting that Brazilian e-commerce has excellent expansion projections, especially when accessed via mobile devices. For a more robust analysis of this market, we recommend this article on National Online Retail Trends.